In this video, Felicia talks about the different factors that could affect your Florida land value. If you’re looking to sell your Florida land or want to know how to find out what your Florida land is worth, knowing what factors affect value can help you determine a number.

From the video:

Hey everyone it’s Felicia from We Buy Your Land for Cash.

Today I want to share some factors with you that will help you figure out the value of your Florida land.

As a land owner in Florida, there are 14 key influencers that you need to watch out for. These things can make or break your land value. When my company invests in Florida land, we check these things carefully.

If you want the pro tips for each of these 14 factors, make sure you fill out the form below to grab your free copy of the guide.

Download Your FREE Florida Land Value Guide

Just put in your name and email, click “Download” and we’ll send you the free guide right away.

Chain of Title

This is the biggest factor. Not all deeds and property transfers are created equally.

The best type of deed is a Warranty Deed. This means that when you purchased the property, the seller pledged or warranted that they owned the property free and clear of any outstanding liens, mortgages, or other encumbrances against it, AND that they warrant this for the history of the property.

Transfers done through a Tax Deed / Lien or Treasurer’s Deed aren’t great. These don’t give you clear and marketable title and will cause a lot of problems if you try to sell your property.

Accessibility

Some properties are only reached by a county easement or an unofficial (privately owned) trail. This normally isn’t a problem for most Florida properties, but you still need to be aware. If you can only access your property through a swamp or by crossing a neighbor’s property, your land value is inherently capped.

If your property is a far reach from any nearby towns or cities, this could be another negative impact on your land value. A lot of people want rural, but they need access to things like grocery stores and gas stations at the bare minimum.

Dues

Outstanding dues against a property have a huge impact on its value. A lot of people don’t know that the outstanding dues get transferred to the new owner when a piece of land is sold.

If you don’t keep up with your property taxes, a Tax Lien can be filed against your property. A Tax Lien is a legal claim against your property while there are debts owing. This can be filed by the County or an individual looking to own your property.

If you pay off your taxes, you can have the lien removed. If you do not pay off your taxes, your property can be seized by the County or sold to another party who has filed a lien against it, at a severely discounted price. The only way you can prevent a Tax Lien from being filed against your land is to keep up with the burden of annual taxes, and pay them every year.

Land Use

Land can only be used for specific purposes, and unfortunately you don’t get to decide what those purposes are. Land use can be restricted at the County or at the municipal / metro level.

A lot of people think they can drive their RV down to Florida in the winter months, and park it on their land and live there for half the year. This is not a guarantee. We know from experience that many Counties in Florida will not allow you to camp or RV on your property.

You have to be weary of the municipal restrictions as well. Some towns or cities require that you keep your land manicured and mowed, even if there’s no building on the lot. If there are many restrictions, and limited uses for your lot, this could be a negative mark against you that will bring down your land value.

HOA or POA

Home Owners Associations and Property Owners Associations are quite common in Florida. HOAs and POAs can be a good thing, they often take care of lawn maintenance and any upgrades or maintenance to common spaces (like a workout center or pool).

You probably wouldn’t mind an HOA if you’re a snowbird who owns a condo in southern Florida because the HOA will take care of the property and facilities while you’re away in the summer months. But for vacant land, HOAs and POAs are often seen as negative because you’re paying all these additional fees and you often aren’t getting any additional benefits.

HOAs and POAs can bring down your land value because they have their own annual and limitations on land use.

Utilities

Power poles are common, but not a given with residential Florida lots. It’s certainly not a given for larger and agricultural plots out of the cities. It can be really expensive to have electricity brought in, and a lot of Florida Counties don’t approve alternative power sources.

City water and sewer is the best option for Florida land, but not having these isn’t as bad as not having power. In this case, you could install a septic or drill a well. However both of these are pricey, and could be a negative factor in determining your land value.

Chances are your Florida lot has internet access and cell phone coverage, especially if it has other utilities in place. This is more of a problem in rural areas (think “flyover states”). If your property is accessible to towns and cities, you shouldn’t have to worry about it.

Flood Zone

Flood zones are quite common in Florida, because the state is so close to sea level. The size of flood zones are growing as well. Your property might be okay this year, but in 2 years from now be in Flood Zone AE – it depends on the weather patterns and severity.

Unfortunately, this means there’s a high chance your Florida lot is or could one day be in a flood zone. If your property is in a Special Flood Hazard Area (SFHA), you are required to purchase Flood Insurance. SFHA include zones: A, AE, AH, AO, AR, V, A99, and VE.

For all other zones, Flood Insurance is recommended – check with your insurance company to make sure it’s not required. Being in a flood zone is not detrimental to your land value. Being in a SFHA requires insurance, and is worse. A SFHA could bring down the value of your property.

Wildlife

If you’re an out of state owner, or aren’t intimately familiar with the area surrounding your property, you may not be aware that there is protected wildlife living on your lot.

In southern Florida, protected wildlife can include:

- burrowing owl

- gopher tortoise

- scrub jay

- types of plants

Not every property or County in Florida will have this wildlife to worry about. For example, the scrub jay is found only in scrub habitat, an ecosystem that exists only in central Florida and has plenty of nutrient- poor soil, suffers the occasional drought, and has frequent wildfires.

For protected and threatened species, you will need extra permits before improving or building on your property. These additional permits can be expensive and could bring down the value of your land.

Wetlands

Wetlands in Florida filter and clean the water we drink, and provide a healthy habitat for wildlife. Sounds great, but it can be a big pain for you if you want to build on the property, and often has a big negative impact on land value.

If building on wetlands, you’ll have to watch out for damaging existing wells. This will require a special permit from the County. Furthermore, you will constantly be fighting with water on a wetlands property – and this doesn’t bode well for property value.

Mangroves are often found in wetland areas. They’re important because they support sustainable coastal and marine ecosystems. They also help to protect land from extreme weather events.

However, mangroves are bad for land value because they’re protected. You can’t destroy a mangrove habitat without permission from the County and the Florida Department of Environmental Protection.

Junk

We have made the mistake of buying property with junk and abandoned trailers and cars on it, and let me tell you from experience, it was costly to have it all cleaned up.

Abandoned vehicles, boats, sheds, trailers – all large objects like this that take work to remove from the property and can’t be solved with a garbage bag could really hurt your property value.

If there’s a building that is structurally sound, like a tool shed or small barn, that might not necessarily devastate your value. If the building is not structurally sound, you need to be very careful because if anyone is hurt on the property, you are held responsible – even if that person wasn’t supposed to be there!

Neighbors

Unfortunately, how a neighbor uses their property affects the value of your property. Thankfully, there are often zoning codes and restrictions in place that prevent things from getting out of hand, but the rules might not cover every distinct situation.

Imagine you’ve purchased a lot in southwest Florida that you want to retire to. You move down there, only to realize that one of your neighbors has decided to use their property as a halfway house, or maybe they’re just really rowdy. They’re outside with loud music, drinking and socializing, all day and all night. This isn’t the type of environment you’ve envisioned for retirement. Not exactly relaxing, is it?

If your noisy or annoying neighbor isn’t breaking the zoning rules or municipal bylaws, often there’s not much you can do about this, even though it’s terrible for your property value. You could try filing a complaint with the sheriff or local police office, but they might not be able to help you if no laws are being broken.

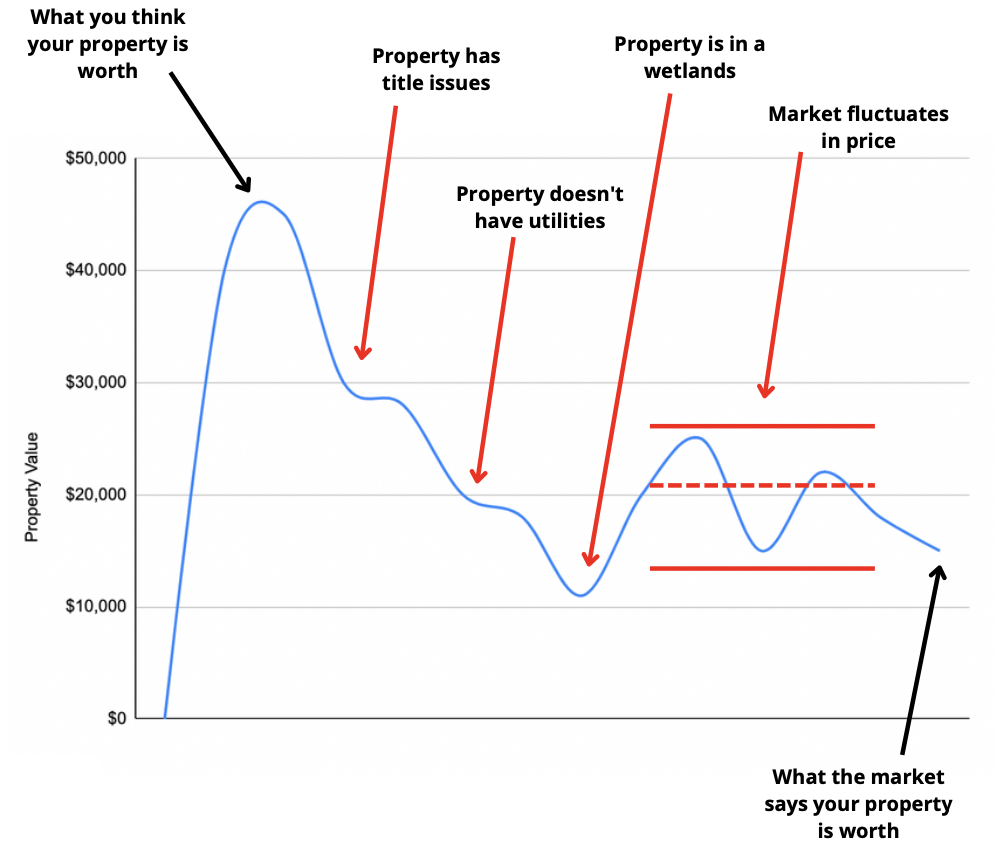

Market Prices

Similar to bad neighbors, this is a tough one to accept because it’s out of your control. This is why location is so important for land ownership. If your property is in a metro area, you can expect more volatility than in a completely rural away far from cities and towns.

That volatility can work in your favor, or against it. You get to ride the high when times are good, but when times are bad, the floor is really going to fall out from under you.

If the marketing is reacting poorly, it’s going to be tough for you to sell your property. In these situations, you likely won’t get whatever the current market value is. You could try holding on to your lot and hope for better times (if you don’t need the cash from a land sale right away).

In a bad market, your property value goes down. Even if your property has no issues, no outstanding taxes or debts, you could still lose money on it.

Natural Disasters

Natural disaster recovery is becoming more and more important. FEMA and the National Hurricane Center have data showing the increasing frequency of major storms.

Unfortunately, a lot of Florida is in a very high or relatively high risk area. This means that the ability to recover is a must-know for land owners. There are some areas of Florida that handle recovery quite well, like Miami. Miami is an international hub, and it’s crucial for the economy there that it minimizes downtime.

Other areas, like Panama City, are not as wealthy as Miami and can’t afford to upgrade infrastructure or have emergency supplies and plans put in place.

Rebuilding after hurricanes takes quite some time. And if the city or County can’t support a healthy recovery, your property could be flooded or covered with debris for months (or years!), leaving your land value negatively affected.

Topography

Sloping is not something that can be easily fixed. If it is fixable, it would require a ton of fill dirt, and that would be extremely expensive. For most buyers, this solution would be out of reach.

If sloping is severe and not fixable, your property value is capped because the property uses are limited. For example, if your lot is too sloped for building (or would cause a building project to be astronomically expensive), that takes out a ton of value to potential buyers. It would also be challenging to pitch a tent or camp on such an incline.

The average elevation of Florida is around 56 feet. If your property is on the lower end of that scale and sits at say, 10 feet, then it has a big disadvantage compared to a property that sits at higher up. A lower elevation in Florida could lead to a decrease in property value.

I know this might feel overwhelming. A lot of land owners who may have inherited or been gifted property, or who bought it sight unseen may not be aware of these factors, and how they can negatively impact land values.

If you are one of these land owners – don’t be hard on yourself. It’s extremely difficult to keep track of all the factors affecting land value.Tracking land value is tricky, it’s like trying to track a moving target.

If you own land in Florida, and don’t want to deal with the headache of valuation and trying to account for all these changing factors don’t worry – you have other options!

The quickest and easiest option for you to get rid of your land headache is to sell to an investor (like our team at We Buy Your Land for Cash).

With an investor you can expect:

- No commissions or fees

- No closing costs

- No hassles

- No marketing or work to sell the property

- Can be done in less than 10 business days

- You get cash in hand

If you’d like more information on how this works or want to know what kind of cash offer we can give you for your Florida land, you can fill out the short form – click here.

Hopefully, this video helps you understand some of the different factors that could affect your Florida land.

Don’t forget to grab your free copy of the Florida Land Value Guide. Just click the link below, and then tell me where to send that guide to. I’ll have it in your email inbox within an hour.

If you liked this video please give it a thumbs up, leave a comment and let me know if this was helpful for you, I want to hear from you guys to learn what content is useful you so I can get the best content possible for you.

Make sure you subscribe so you can see more info like this, and all of our newest property tours.

If you have any questions about these 14 factors, leave a comment below and I’ll help you out. Thank you for watching, and I’ll talk to you soon. 🙂

Want to learn more about how to sell your Florida land fast? Call or text us at (313) 307-6737 to see how Buy Your Land for Cash can help you!

Want Your Own Florida Land Value Guide? (complete with a list of factors that could bring down your property value!)

You can get yourself it for free – just fill out the form below!

Download Your FREE Florida Land Value Guide

Just put in your name and email, click “Download” and we’ll send you the free guide right away.